The sales and operationsengine for mortgage teamsThe salesand operations engine

for mortgage teams

Your workflows, system-enforced across sales and ops. Guided by AI.

Built for modern mortgage teams.

A simple but powerful transformation

Become a leader in all four categories

Incoming Call

AI Transfer

Bob Borrower

(999) 999-9999

Leaving voicemail…

Send a custom SMS

Schedule a closing date

Voicemail skipped

Speed-to-Lead

Make contact before the competition

Lead routing, prioritization, and AI-driven outbound work together so LOs engage borrowers immediately and no lead falls through the cracks.

Borrower Experience

Deliver a consistent, high-quality borrower experience

All calls, texts, updates, and alerts live in one inbox and stay in sync across web and mobile for clear, timely communication.

Talent Advantage

Attract and develop top producers

Live floor visibility, call monitoring, and coaching tools help managers ramp new hires faster and keep top LOs productive.

Cost Per Closing

Reduce rework and prevent loan implosions

System-enforced guidelines, automated checks, and LOS integrations catch issues early so files move forward clean and complete.

“Gizmo is the first tech decision we don’t regret. Our team finally has a system built for conversion.”

Migrated From:

Faster, cleaner loans in 3 steps

The easiest way to shorten cycle times and eliminate rework.

Secure SSO instantly connects Gizmo to your organization. No setup, no user provisioning.

Get a dedicated intake URL. Share it with your lead providers and you are live.

Gizmo runs alongside your LOS, syncing data in the background while your team works in real time.

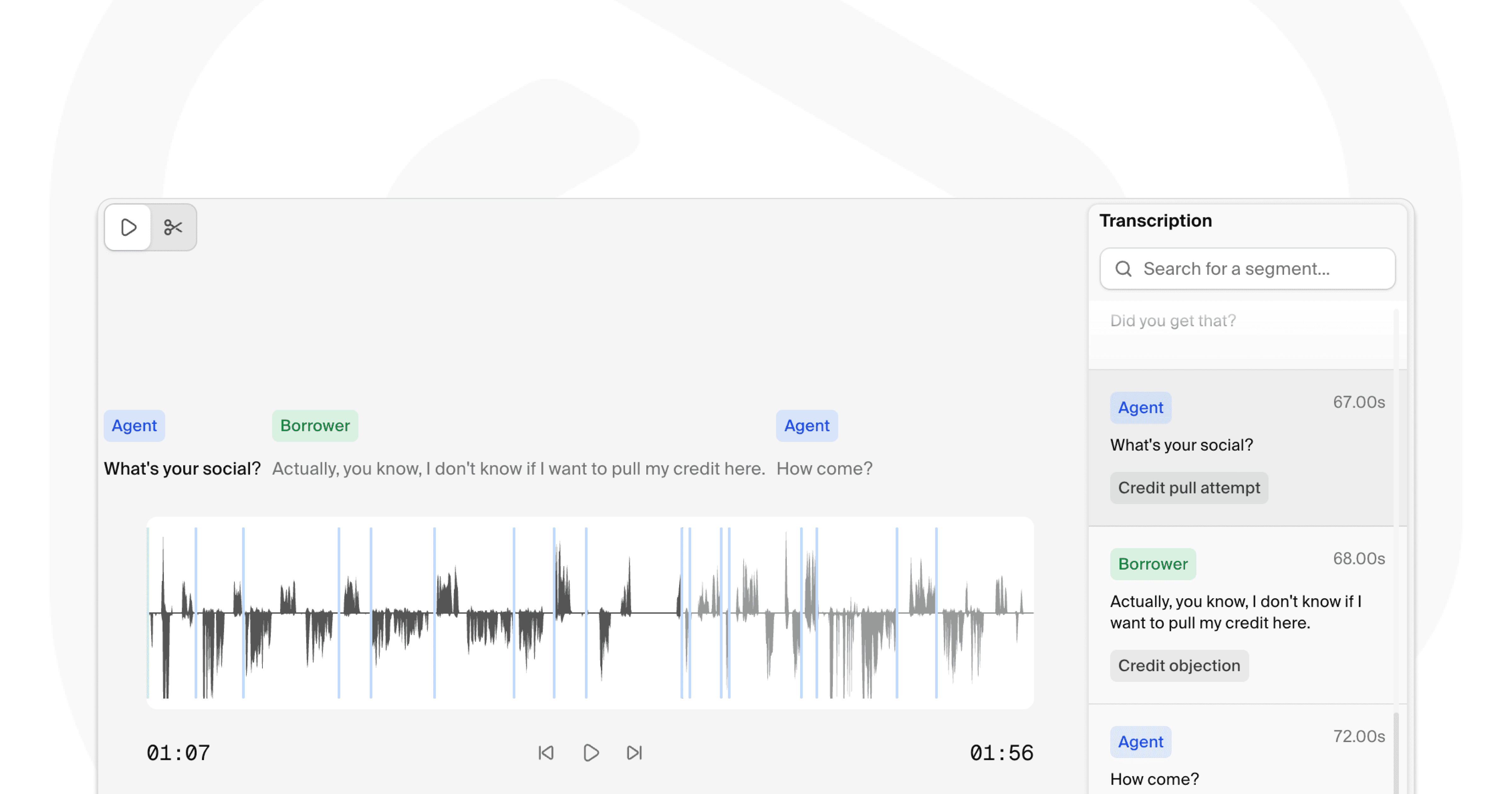

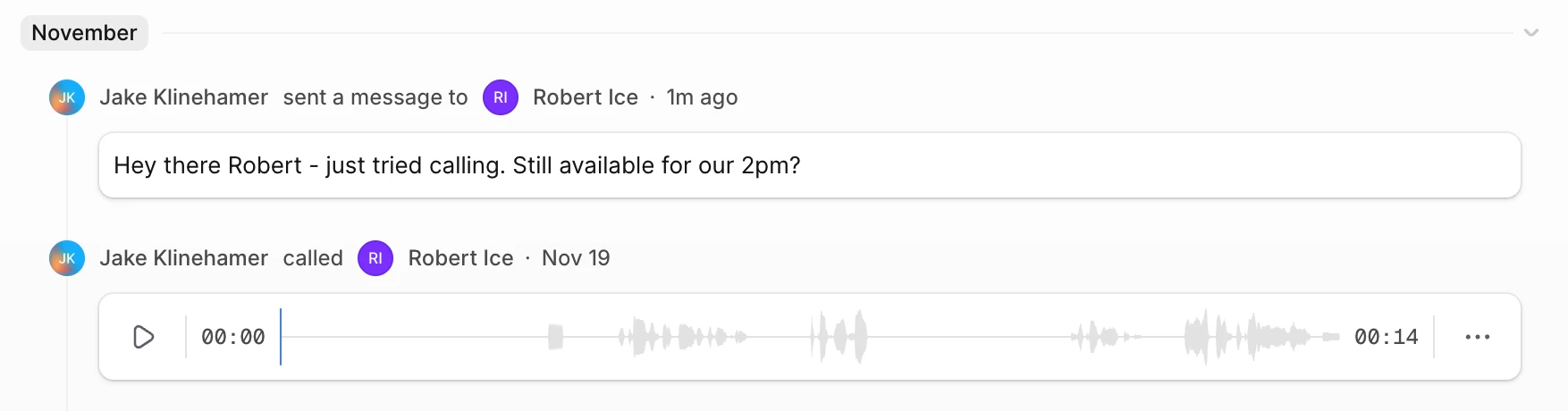

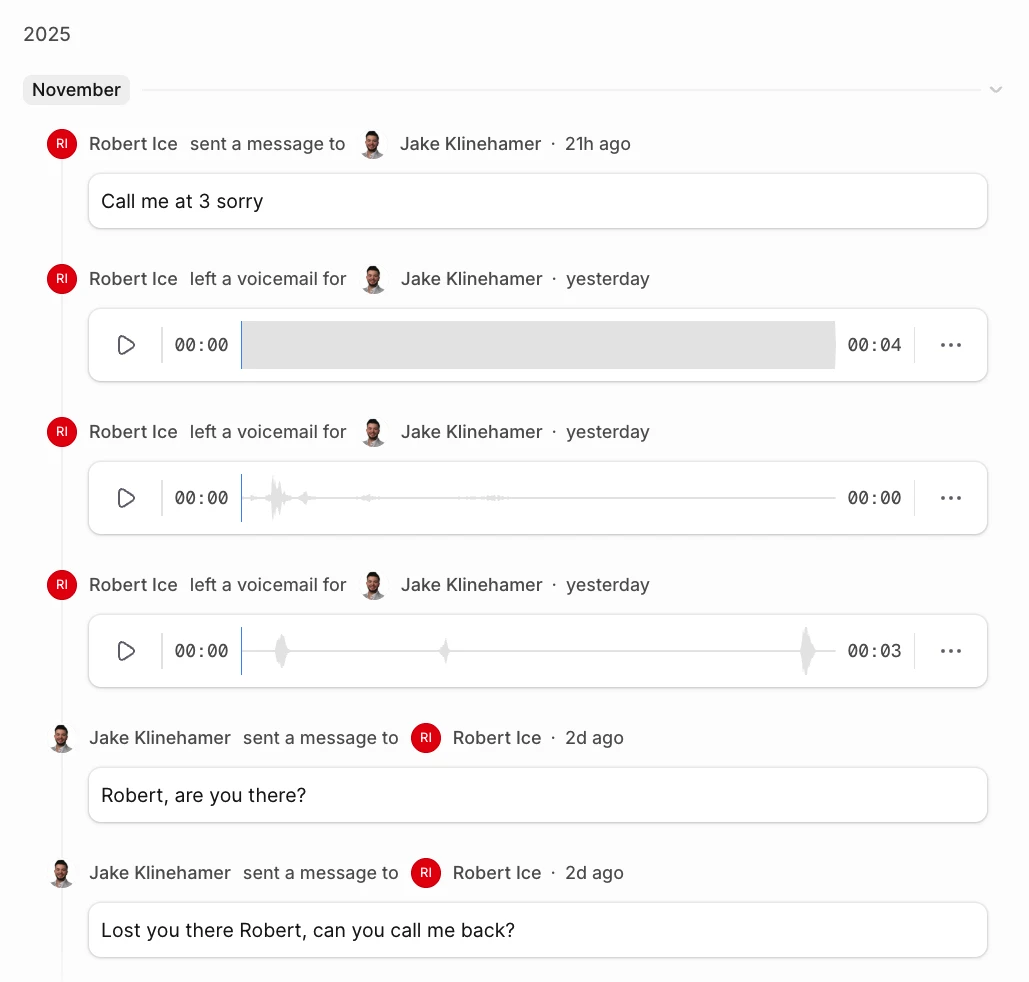

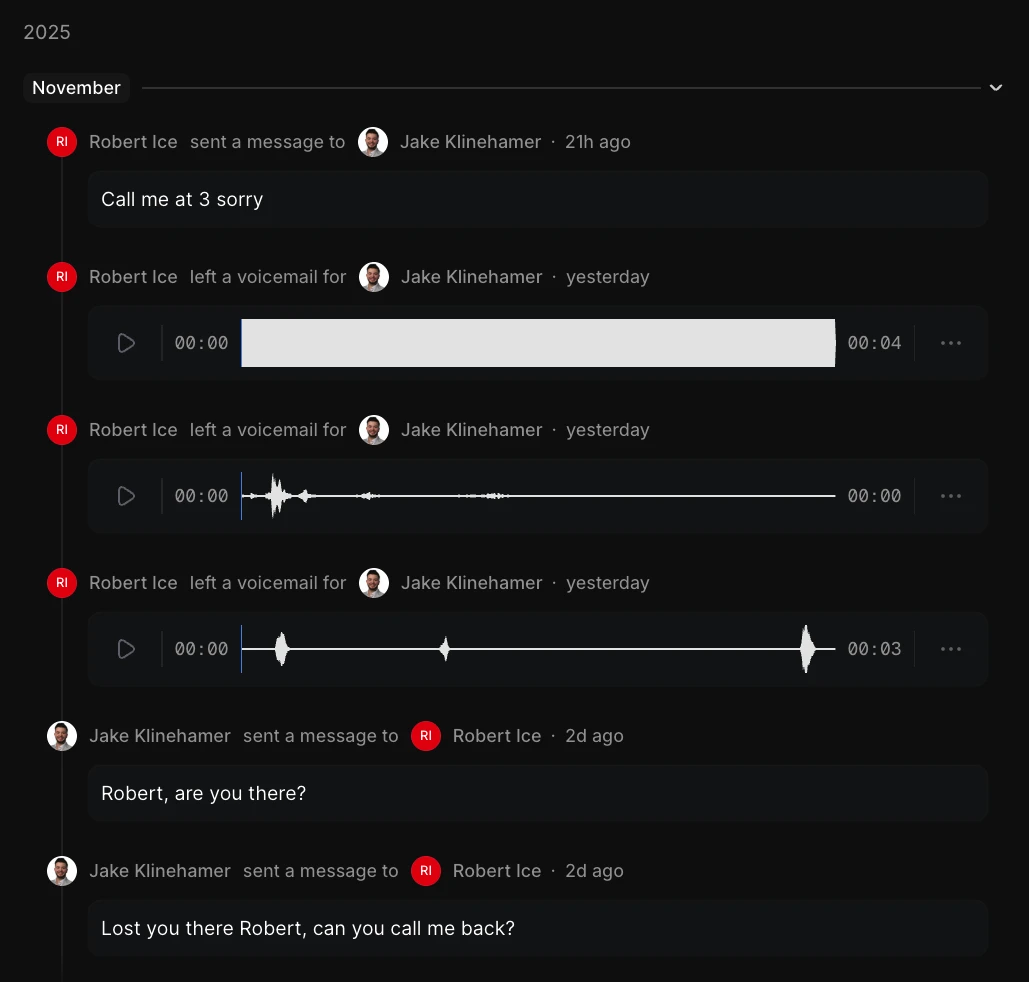

Conversations

Centralize borrower communication

Keep every call and text where the work happens, tied directly to the loan and the LO's workflow.

- Click-to-call.

- Start calls directly from the lead record, with recording and QA handled automatically.

- Reputation protection.

- AI monitors your phone numbers continuously and rotates them out if they become blocked or flagged.

- Mobile app integration.

- Use our mobile app to communicate with borrowers on the go. Synced in real time with the web app.

Contact Rate

By Lead Source

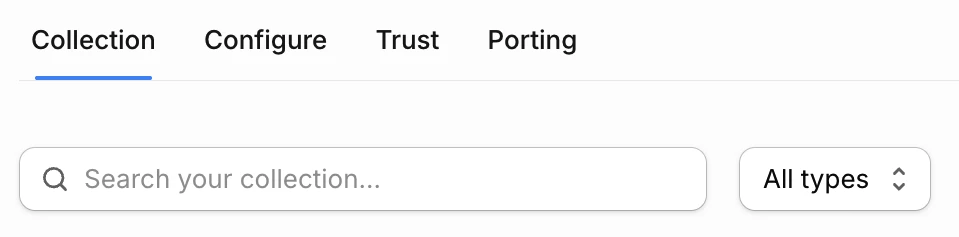

Origination

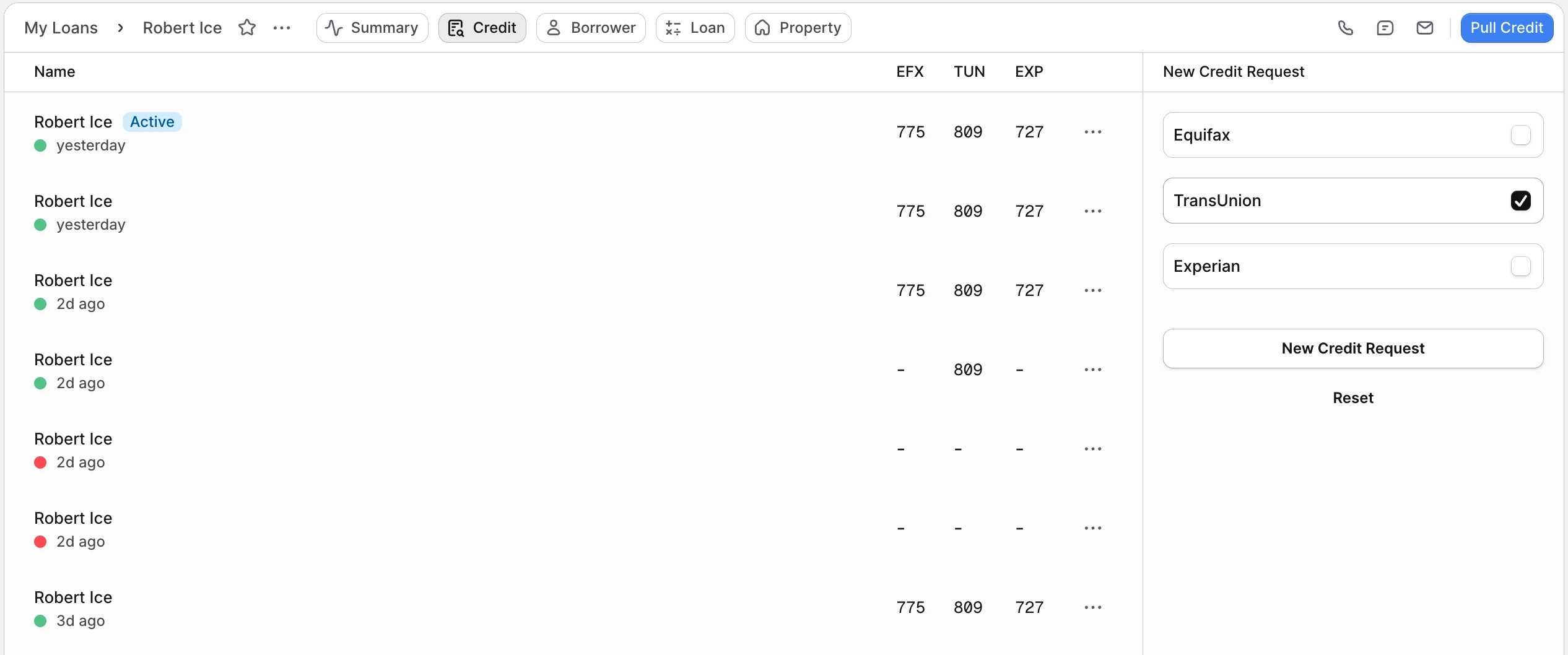

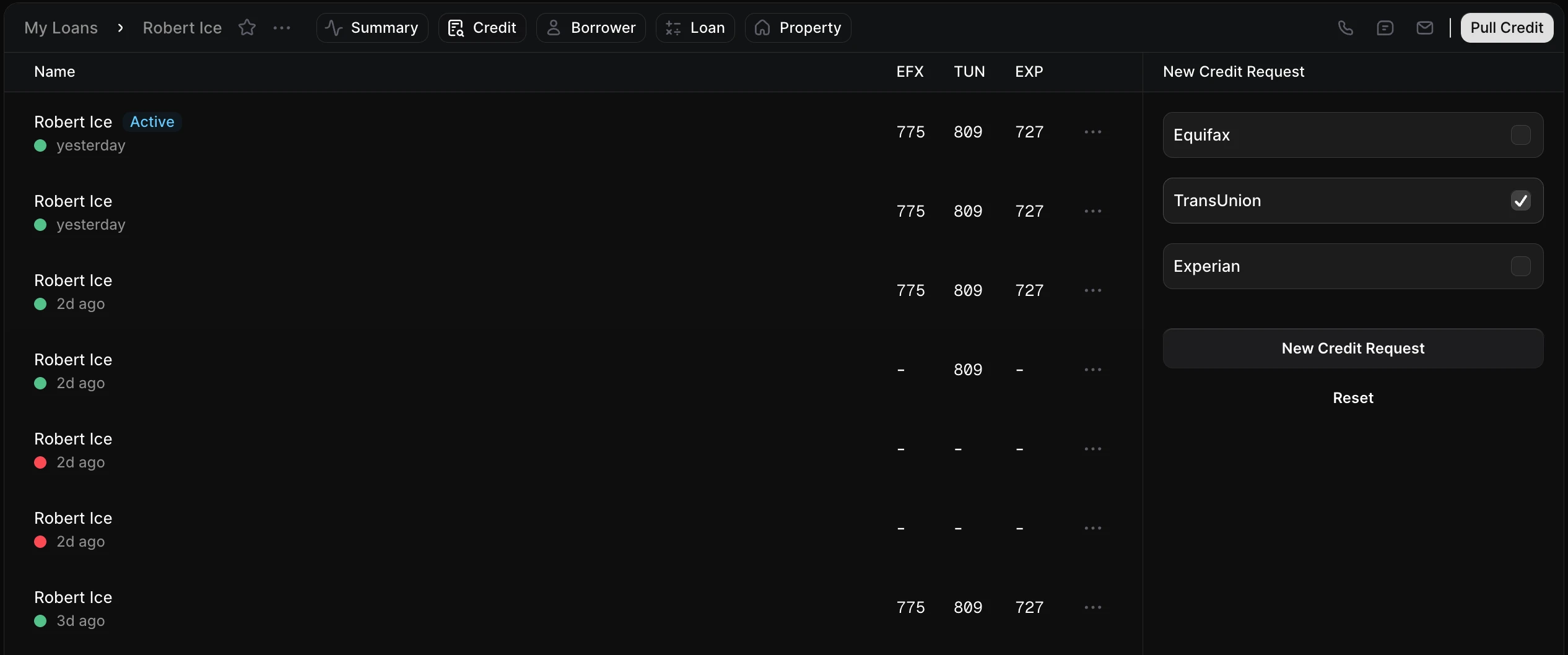

Unify the lead process and the loan process

Empower your team to take action from the same place they communicate. Eliminate context switching and keep your LOS in the background.

- Credit in one click.

- Pull and view tri-merge credit directly from the lead record—no separate portals or manual uploads.

- LOS syncing.

- Sync loan statuses, disclosures, milestones, and borrower information from your LOS so LOs always work with accurate data.

- Borrower context.

- Surface property data, credit details, loan information, and past interactions in one unified view.

- Automated status updates.

- Keep every lead up-to-date with automatic status changes triggered by LOS events and borrower activity.

- Document visibility.

- Expose disclosures, uploaded docs, and LOS-generated files directly inside the lead profile for faster borrower follow-up.

- Property data enrichment.

- Automatically add valuation, ownership, and property details so LOs can tailor the conversation instantly.

Floor

Multiply sales skill across your floor

Drive consistent outcomes with real-time visibility and clear intervention points.

- Monitor live calls.

- See exactly what's going on across your sales floor in real time.

- Take control of sales.

- Chat, coach, or join live calls to move deals forward.

- Floor performance.

- See contact rates, call volume, and queue load across the entire team at a glance.

AI outbound

Generate additional at-bats for your team

Your AI agents engage new leads immediately, qualify them conversationally, and live-transfer warm borrowers to your LOs—often doubling contact rates without adding workload.

- Instant engagement.

- AI calls new leads immediately, introduces your brand, and starts a natural conversation before the borrower goes cold or shops competitors.

- Warm transfers.

- When a borrower is ready to talk, AI transfers the call live to the next available LO, delivering a steady stream of ready-to-talk conversations.

- Full transparency.

- Managers see every AI call, transcript, and outcome in real time, with the ability to monitor performance and optimize the funnel.

Metrics

Gizmo increases first conversations, improves speed-to-lead, and keeps your floor consistently productive — without adding headcount or extra tools.

2x

More first conversations

Across teams using AI Outbound + Next-Lead automation.

40-60%

Faster speed-to-lead

From automated routing, instant engagement, and unified calling.

+30-50%

LO talk time

Real-time queue progression keeps agents moving.

5 out of 5 stars

“Working with 10,000+ new leads each month, every minute matters. Gizmo gets us in front of borrowers faster and creates more live conversations for our team — without adding to anyone's workload.”

See why high-converting mortgage teams run on Gizmo

A unified system for leadflow, calling, warm transfers, and LOS data.

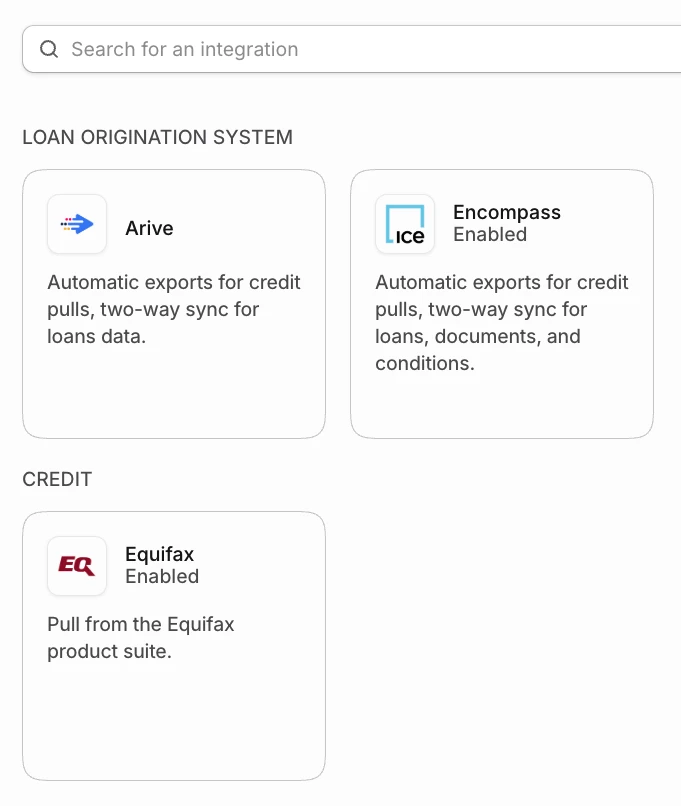

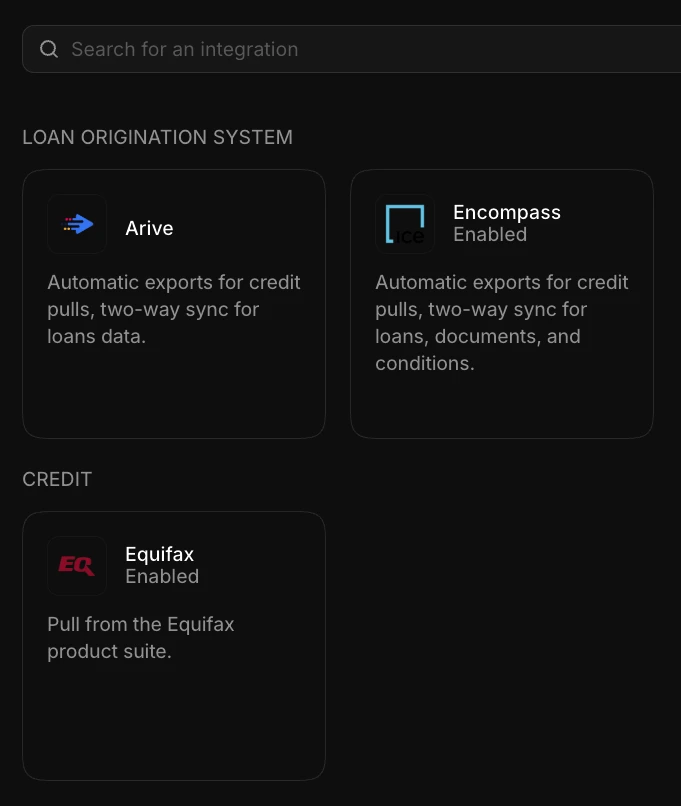

Implementation

Fast deployment. Zero disruption.

We handle LOS setup, call routing, and lead source mapping so your team can onboard quickly without slowing down operations.

We configure LOS sync for you.

Gizmo connects to your LOS, credit provider, and property data sources with minimal lift from your IT team.

LOs onboard in under an hour.

Simple, intuitive workflows mean your team is productive immediately.

Numbers and routing handled.

We migrate or provision numbers, set up IVR, and configure routing so your floor is ready on day one.

Full transparency.

Managers see every AI call, transcript, and outcome in real time, with the ability to monitor performance and optimize the funnel.

Ready to see Gizmo in action?

Get a personalized walkthrough of how Gizmo improves speed-to-lead and lead conversion for high-volume mortgage teams.

From the blog

Learn how to grow your business with our expert advice.

Mortgage Tech is Fundamentally Broken